Hagerty released its monthly collector car market rating number just as the auctions on the Monterey Peninsula were ending, which means the August rating does not reflect anything that happened last week.

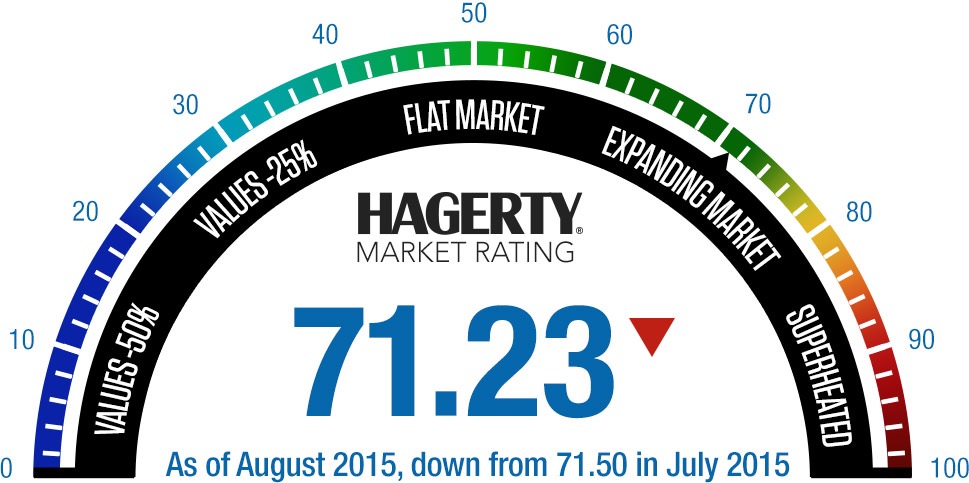

As a result, the August rating of 71.23 is a quarter-point lower than the rating for July. Nonetheless, the rating, presented much like a tachometer sweep, still shows the classic car marketplace to be expanding.

“Although August’s Hagerty Market Rating doesn’t reflect results from the Monterey auctions, preliminary totals from those sales echo what we are seeing overall: exuberant buying is being replaced by more rational decisions on both the buyers’ and sellers’ parts,” McKeel Hagerty, the insurance and car value-tracking company’s chief executive, says in a news release.

“While some observers may point to slowing appreciation as a sign of market contraction, at this point it seems to be a return to more sustainable growth rates.”

The Hagerty news release pointed to several reasons why the August number of 71.23 was lower than the 71.5 figure for July (Note: due to new national inflation figures from the federal government, Hagerty revised the July rating number downward from its original 71.59 figure):

• After dropping for the first time in a year in July, private sales activity is essentially flat for August. Hagerty added that while private sales are 12 points higher than year-ago numbers, they are down half a point during the last three months.

• Auction activity is down for the third month in a row and is at its lowest point since August of 2013. Hagerty attributes much of this to fewer cars being offered at recent auctions.

• Insured values for collector cars continue to rise, but the increase in August was the smallest in the last six months.

Ferrari 330 GTC among cars accelerating in valueHowever, values on “high-end” vehicles jumped 2.3 points to an all-time high in the past month. Hagerty added that 25 percent of those value increases at the top of the market involve the values of Porsches and Ferraris, with the Porsche 930 Turbo and 964 Turbo and the Ferrari 330 GTC showing the greatest increase.

• An increase in the S&P 500 and a decrease in gold prices are effecting where investors are putting their money.

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late 2010.

The monthly rating was at an all-time high of 72.04 in May.