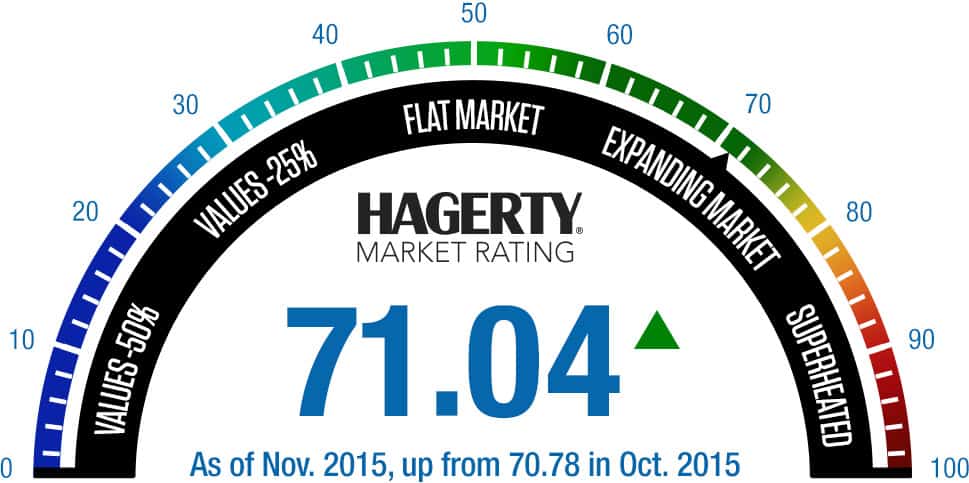

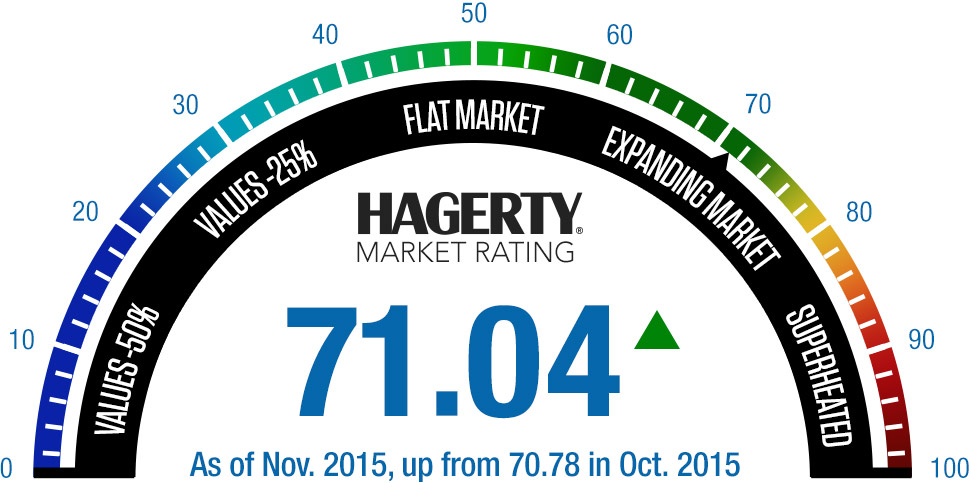

For the first time in sixth months, the Hagerty Market Rating of the health of the classic car marketplace is up for November. The new figure is 71.04 compared with 70.78 for October.

Reasons include a 15-month high in median sales prices at classic car auctions and an increase in “expert sentiment” in reaction to an increase in prices for entry-level cars as the next generation of collectors enters the market seeking cars from their youth. Those cars include models from the 1980s, ’90s, and early 2000s.

Expert sentiment is one of eight categories considered in the monthly ratings.

“While some parts of the market have experienced slower growth in 2015 we continue to see more activity in collectibles from the 1980s and newer,” McKeel Hagerty, chief executive of the world’s largest provider of classic car insurance, said in a news release.

“Younger buyers are starting to spend money on the cars they grew up with, and older collectors are finding a new appreciation for these same models,” he added.

“Interest in iconic, high-horsepower muscle cars like the Plymouth Road Runner — one of the most famous Mopar models — continues to gain traction after a prolonged hangover following 2007’s market correction.”

While the median prices are up, Hagerty researchers found that the number of cars sold at auction has hit an 18-month low.

“Broad economic inputs have helped the Hagerty Market Rating as well,” the news release continued, “particularly as the stock market has improved by nearly 10 percent since September 1.”

On the other hand, the report noted, “insurance activity,” another of the categories considered, has “dragged on the overall number, as broad-market insured values recorded their single biggest monthly decline in 34 months.

“Values for high-end cars saw a similar decline,” the company reported.

The news release pointed to the 1969 Plymouth Roadrunner, 1957 Chevrolet Corvette and 1970 Dodge Challenger as the vehicles with the largest increase in average price at auction in the last month, while the 1958 Porsche 356A, 1955 Mercedes-Benz 500SL and 1958 Mercedes-Benz 190SL experienced “significant slowing” in their values.

The Hagerty Monthly Index also reported that because of recently released national inflation numbers, its October figure was revised from 70.78 to 70.61.

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late 2010.

The monthly rating was at an all-time high of 72.04 in May.