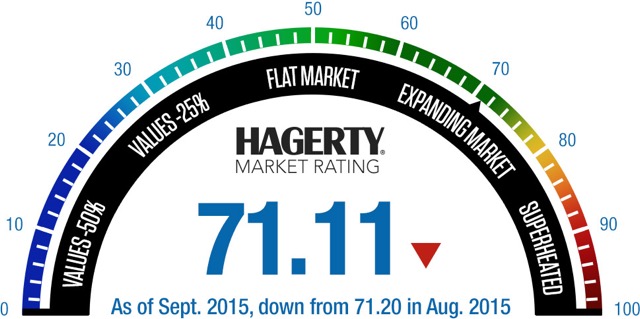

Despite sales figures at high-dollar auctions last month on California’s Monterey Peninsula, the Hagerty Market Rating of the collector car marketplace is down for the fourth month in a row. The August index number is 71.11, which Hagerty reports as an indication that the market continues to expand and thus is in a healthy place, neither flat nor superheated.

“The current shift is indicative of a market slow-down, not a bursting bubble,” Hagerty, the insurance and vehicle value-tracking company, said in a news release accompanying the monthly index chart.

Hagerty also noted that six of eight categories it tracks for the index increased in value compared with month-ago figures, but added that “expert sentiment” fell another 1.4 points and has dropped 2.7 points since peaking in January 2013.

“While Expert Sentiment has steadily moved towards a ‘flat’ rating, this decline has taken place over 32 months. For comparison, this metric fell 28 points in 8 months during the 2008 market correction,” the company’s news release reported.

Also cited as factors in the latest ratings were the “plummeting stock market” and rising gold prices.

“Prices coming out of the Monterey auctions helped bolster this month’s rating, but were not enough to offset volatility in the broader economic landscape,” Hagerty chief executive McKeel Hagerty said in the news release.

“Overall, rationality is replacing exuberance in the market, which is ultimately a healthy and sustainable transition.”

The news release also noted the “big jump in average sale price” at the Monterey auctions resulted in a jump of more than half a point in what it terms “auction activity.” In addition, Hagerty reported private sales of classic vehicles increased after two consecutive months of declines.

Further, “broad market insured values” have established an all-time high as a result of 17 consecutive months of increase, Hagerty reported, although the rate of grown has slowed in the last five months.

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late in 2010.

The monthly rating was at an all-time high of 72.04 in May.