If the astronomic prices paid in August at auctions on the Monterey Peninsula weren’t enough to boost the monthly Hagerty Market Rating for September, there was little chance of a change of direction in October.

Hagerty announced the latest figures Monday. They were down, not only for the fifth consecutive month but the rating suffered the largest one-month drop since July 2013.

“The volumes sold at auctions remains strong, and a rebounding stock market brought some optimism to this month’s Market Rating,” McKeel Hagerty, chief executive of the classic car insurance and value-tracking company, said in a news release.

“The market is still growing,” he added, “but the growth trend continues at a slower rate.”

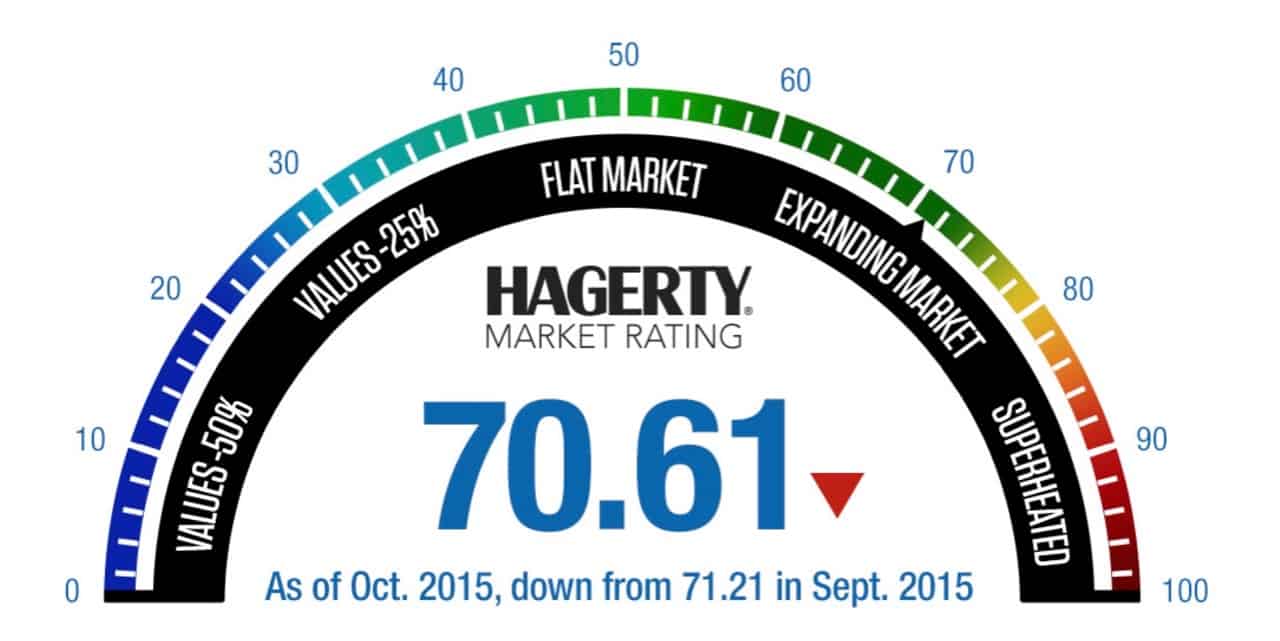

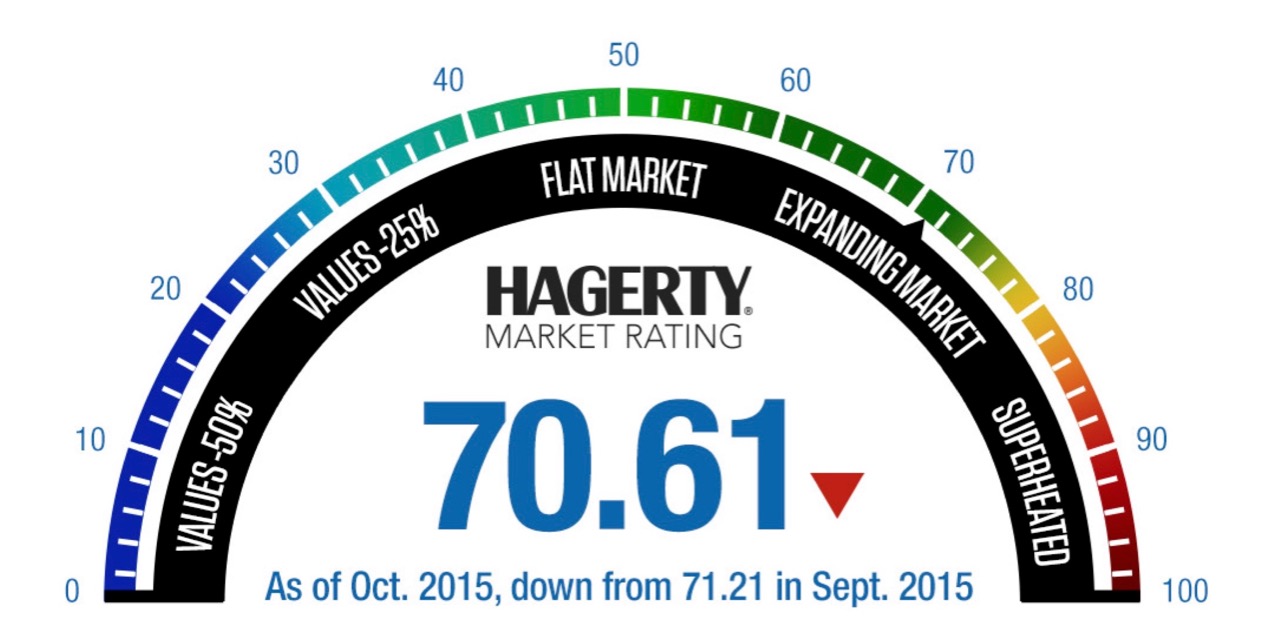

The September figure was revised from 71.21 to 71.20 after the federal government released its latest inflation numbers. Pending that report at the end of October, the preliminary rating for this month slumped to 70.61.

Among the reasons were:

- A three-point slip in Expert Sentiment as market observers saw price changes smaller than those earlier in the year.

- Despite a strong volume of cars offered and sold at auction, there was only a modest increase in Auction Activity.

- As the stock market rebounded, Correlated Instruments jumped by 2.66 points to become the most optimistic input for the Hagerty Market Rating.

- After 17 consecutive monthly increases, activity among Broad Market Insured Values declined slightly, Hagerty’s news release reported, adding that the ratio of high-end cars increasing versus decreasing their insured values dropped as well.

- Transactions Among Private Parties, a factor that includes average sale prices achieved, took its largest fall in more than two years.

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late in 2010.

The monthly rating was at an all-time high of 72.04 in May.