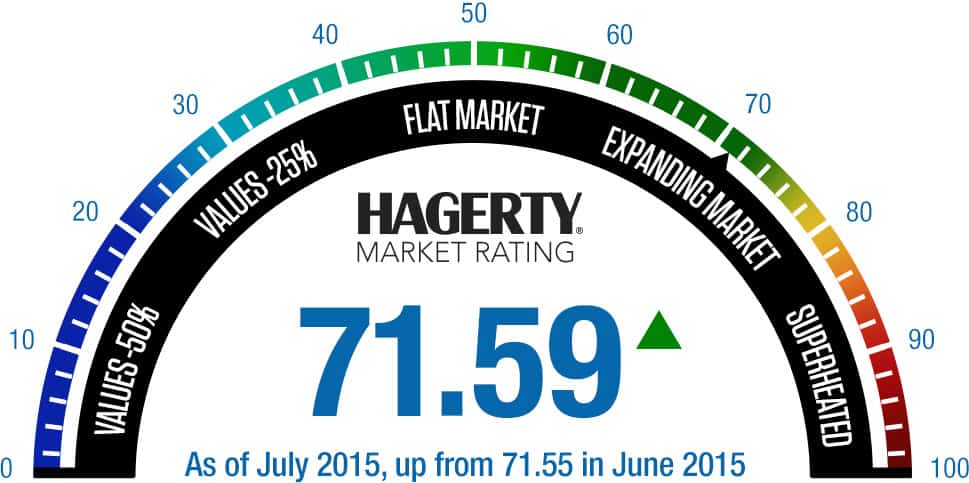

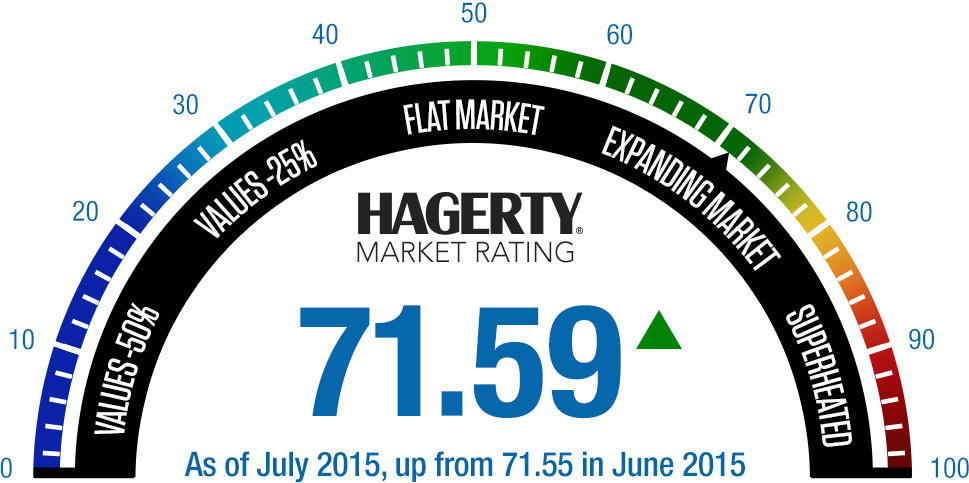

After a June swoon that took the Hagerty Market Rating to its lowest point in 14 months, the tach-style chart tracking the health of the collector car marketplace rallied slightly in July. On a 100-point scale, the rating was 71.55 in June and is 71.59 this month.

After a June swoon that took the Hagerty Market Rating to its lowest point in 14 months, the tach-style chart tracking the health of the collector car marketplace rallied slightly in July. On a 100-point scale, the rating was 71.55 in June and is 71.59 this month.

Hagerty’s news release cited:

- Private sales dropping for the first time in a year;

- Average sales price and percentage of cars selling for more than insured values also fell from June to July;

- High-end insured values dropped for the first time since February, and added that value increases for Mercedes-Benz 300 SL and 190 SL models have dropped significantly in the past six months while those for Porsche 356s from the 1950s also have “dropped noticeably;”

- Drop off in value of 1950s, ’60s and ’70 s domestic classics;

- Expert sentiment remains flat on a month-to-month basis, although Hagerty added that the sentiment usually “trends down” after the sales at Amelia Island and remains that way until the auctions at Monterey.

On the other hand:

- Values are increasing for 1980s and 1990s vehicles, especially those from foreign automakers.

“We are evaluating the upcoming Monterey auction offerings, and the overall market has stabilized over the past 12 months,” McKeel Hagerty, chief executive of Hagerty, said in a prepared statement.

“There will undoubtedly be many exciting world-record prices on the top end, but we are especially watching the growing trend of the market recognizing 1980s and 1990s vehicles for their increasing collectability. For example, more Ferrari 308/328s and Porsche 911 930 Turbos are making their way into the Monterey auctions in greater numbers. Last year, Monterey auction week saw five Ferrari 308/328s and one 930 Turbo; this year they have more than 10 of each. The auction houses are clearly responding to consumer demand for later model years.”

The Hagerty news release added that, “Monterey is a pivotal moment every year for the market as a whole, and expert sentiment is generally much more conservative than what all the general anticipation and fanfare in the media leading up to the sales would lead one to believe.”

The Hagerty Market Rating is based on a weighted algorithm that considers 15 proprietary data points in eight categories, including public auction and private sales, values of insured cars, price-guide values, Hagerty’s own index system and input from industry experts.

The rating, reported at the middle of each month, is based on a 100-point scale and is presented in the form of a tachometer-style gauge, complete with a “superheated” red zone, a sort of warning that we’re approaching a possible burst of the bubble. Ideally, the market cruises along comfortably in the 60- to 80-point “expanding” zone.

Although first released in January 2015, Hagerty applied its formulas to the classic car marketplace dating back to January 2007. The rating then was in the low 60s. During the economic recession, it slumped to the high 40s and has been on an upward trend since late 2010.

The monthly rating was at an all-time high of 72.04 in May.